How Mortgage Acceleration Works

There are three things you need for this to work for you:

-

Detailed Budget

Look at how much money you earn each month and balance it with how much you are spending each month. The program only works if you are making more money than you are spending.

-

Line of Credit (LOC) or Interest Bearing Account

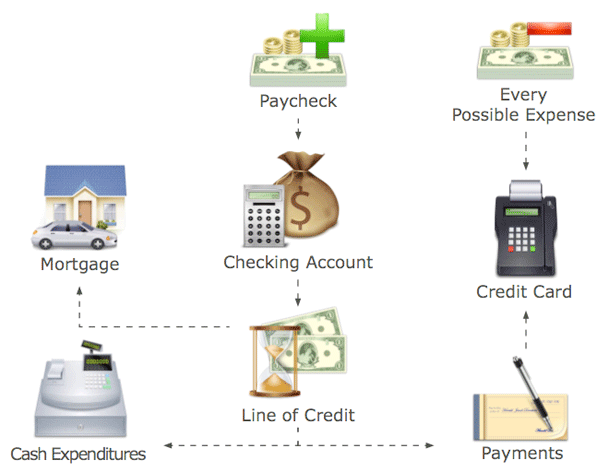

Our program uses a line of credit as a tool to drive the program. The line of credit must have the capacity to operate just like your checking account and must be set up with an open-end interest calculation. The LOC with our web-based software will create an environment in which the money in your line of credit account generates an interest cancellation on your primary mortgage. The program can also be used with an interest bearing account such as a checking account, savings account, or retirement account. The interest bearing account is the perfect solution if you don't qualify for a line of credit because it allows you to start saving interest right away.

-

Software Program

Our program contains an algorithm that systematically creates the highest interest savings possible in the least amount of time. Each individual, due to the uniqueness of their situation, requires a custom plan to achieve optimal results.

Homeowners in Australia and the United Kingdom have been using a similar system for the last 12 years. In fact, more than a third of the households in Australia and about one fourth of the households in the United Kingdom are currently using a program to accelerate their equity.

Many Fortune 500 companies use a banking technique called a "sweep account". This technique is used to reduce the daily calculated interest. Big companies started moving or "sweeping" their bank accounts daily to an outstanding interest bearing loan to reduce average daily interest.

The media has recently done several stories on this "Mortgage Acceleration" Software. In May 2007, the Las Vegas NBC news affiliate Channel 3 did a special on how the program was starting to get more and more popular in the United States.

Also, MSN Money recently published an article called "A new way to pay off your house."

Essentially, our program allows you to use proven and tested principles to help beat the banking industry. In life, we are taught to earn money and put it into a checking or a savings account to protect it and maybe earn a little bit of interest. By doing this, we are giving the bank a loan so it can invest our money and make a higher return. We help you make your money work for you through a line of credit account that is used just like your checking account. It’s easy and it does not require more work than you are already doing now with your checking account.